Widget

153,000 borrowers are getting their loans automatically canceled thanks to the SAVE Plan

Today, the Biden-Harris Administration announced that nearly 153,000 borrowers enrolled in the Saving on a Valuable Education (SAVE) Plan are getting their loans canceled thanks to early implementation of the shortened time to forgiveness component of the new repayment plan. We previously wrote about this issue in our January blog post, but the first round of borrowers eligible for cancellation will now officially receive the good news that their loan balances have been wiped out.

This big news is an important reminder that many more borrowers could be eligible for loan forgiveness if they take a few key steps–including signing up for the SAVE plan and applying to consolidate FFEL, HEAL, or Perkins loans by April 30, 2024.

When can I qualify for loan cancellation under the SAVE Plan?

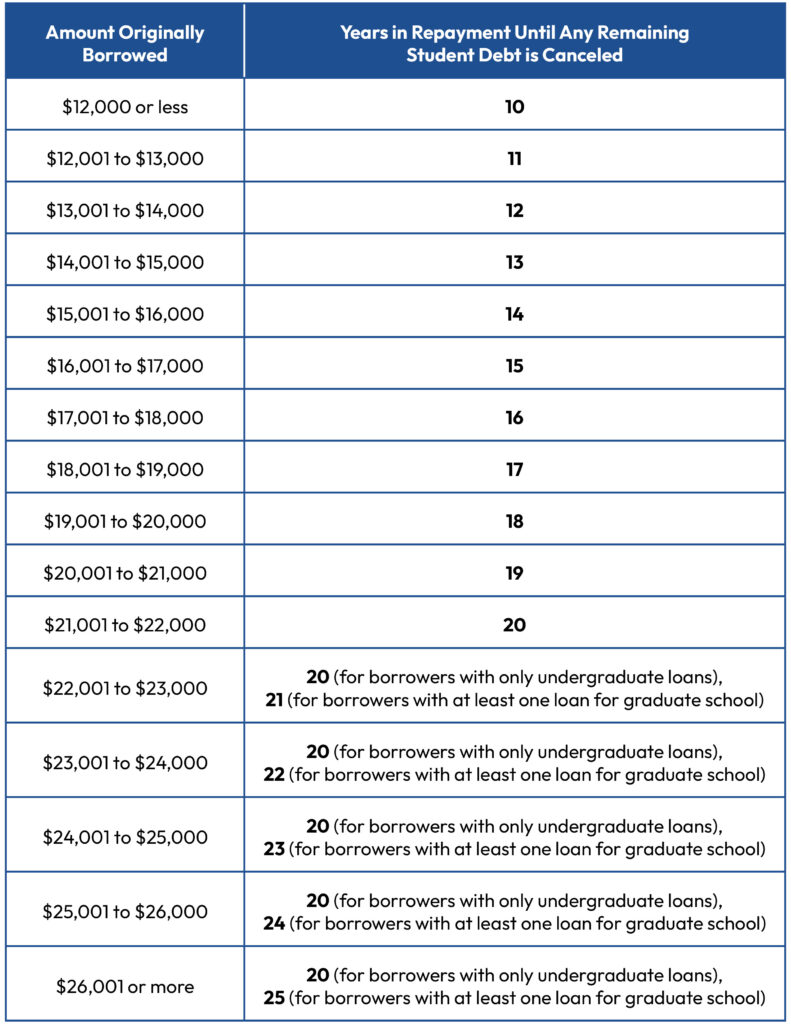

Starting this month, borrowers enrolled in the SAVE Plan who originally took out $12,000 or less in federal student loans, and who have made at least 10 years of qualifying payments, will have any remaining balance on their loans automatically canceled. People who borrowed more than $12,000 may also be able to get their loans canceled sooner. And thanks to the one-time payment count adjustment, borrowers may be able to get retroactive credit for time already spent in repayment.

See the table below for when a borrower will be eligible to have their debt canceled based on how much they originally borrowed in federal student loans.

Do I need to do anything to get credit toward loan forgiveness under the SAVE program?

If you are already enrolled in SAVE, you do not have to do anything other than remain in the SAVE program and continue making any required monthly payments. Once you reach the required amount of time in repayment (see the table above), the Department will cancel your remaining balance automatically. You should get an email or a letter when this happens.

If you are not enrolled in SAVE, you will need to sign up if you want to benefit from this new timeline for loan cancellation.

I have Direct Loans, how do I sign up for the SAVE Plan?

If you have Direct Loans that you took out for your own education (remember Parent PLUS loans are not eligible for SAVE), you can sign up for SAVE online at studentaid.gov/idr or by calling your student loan servicer and asking for help enrolling in SAVE. Applying online should take about 10 minutes or less.

What if I have FFEL, HEAL, or Perkins Loans?

If you have older federal student loan types, including FFEL, HEAL, and Perkins Loans, you first have to consolidate those loans into a new Direct Consolidation Loan. On the consolidation application, you’ll be asked what type of repayment plan you want to enroll in. You can then select that you want to sign up for the SAVE plan. The whole process should take about 30 minutes or less.

Important: If you apply to consolidate your loans by April 30, 2024, then you may get more credit toward loan cancellation under the one-time payment count adjustment. For more information on consolidation, see our blog post on the deadline here.

What if my loans are in default?

If your student loans are in default, you can take advantage of the Fresh Start program to get out of default and sign up for SAVE. If you have defaulted FFEL, HEAL, or Perkins loans, you still have to consolidate to enroll in SAVE.

What if I have Parent PLUS loans?

Unfortunately, Parent PLUS borrowers are generally not eligible for SAVE, although they may be able to access the plan for a limited time through a more complicated workaround (see here for more).

Were your loans canceled under the new SAVE plan? Tell us!

NCLC is collecting stories from borrowers who have benefited from cancellation programs such as the SAVE plan. If you got the good news that your loans were canceled, or if you want to tell us about other issues with your student loans, share your story with us here. Your stories help us advocate to make the student loan system work for borrowers.